The 10 Most Tax-Friendly States to Register an RV

As an RV owner, one of the decisions you have to make is where to register your vehicle. Each state has its own rules and regulations regarding taxes and registration fees, and these can have a significant impact on your budget.

In this article, we'll take a look at the most tax-friendly states to register an RV, so you can make an informed decision. Let us help you keep the most money in your pocket and not the IRS's!

Introduction

The decision to buy an RV is a big one, and it comes with a lot of considerations. One of the most important of these is where to register your vehicle.

There are a number of factors to consider when making this decision, but one of the most significant is taxes. Different states have different tax structures, and this can have a major impact on your overall costs.

Do I Have to Register My RV in the State Where I Live?

In short, no. You can register your RV in any state that allows out-of-state registration.

However, be sure to check the rules and regulations of the state you choose, as they may have specific requirements or fees for out-of-state registrations. And this may add a bit to your budget.

Can I save money by registering my RV in a different state than where I live?

Potentially, yes. By registering your RV in a tax-friendly state, you may be able to save money.

So, if you consider this option, it has to be worth it. And that is why it is important to select a tax-friendly state for the registration of your RV.

What 3 Factors Make a State Tax-Friendly for RV Registration?

Before we dive into the specific states, it's worth taking a moment to discuss what main three factors make a state tax-friendly for RV registration:

1. Sales Tax Rates

If you're buying a new RV, you'll likely have to pay sales tax on the purchase. Some states have much lower sales tax rates than others, which can save you a significant amount of money. And we will get into how much state tax you have to pay off the total amount of your RV.

2. Registration Fees

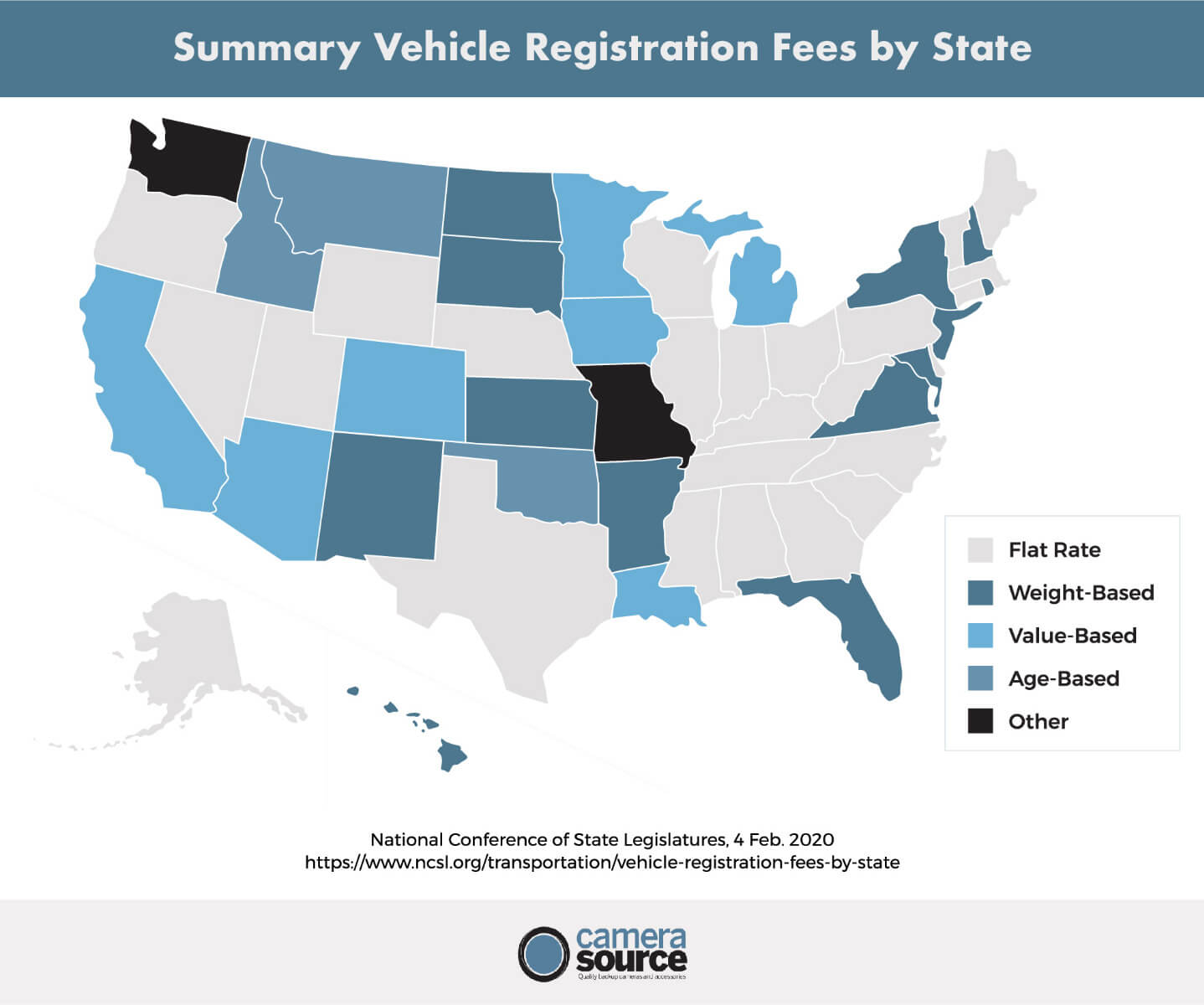

Every state charges a fee to register your RV, but these fees can vary widely. This is because the registration fee depends on multiple factors per state. There are multiple ways you can charge a registration fee depending on the state:

- Flat fee

- Fee per weight

- Fee per age

- Fee per value

- Or other fees like title fees

Although, according to RV Blogger, you will likely end up paying anywhere from $30 to upwards of $800 US dollars. Check to see where it ranges in the state you would like to live in here.

You can also check out how each state chose to charge in this map and consult their website for each state’s specific information.

Types of Registration Fees per State | NCSL

3. Property Tax

In some states, you'll have to pay an annual property tax on your RV. This can be a significant expense, so it's worth considering when making your decision.

You can find a property tax calculator online to consider if this is an expense you can make or not. One like this one for example.

Some states have other taxes and fees that can impact the cost of RV ownership. For example, some states charge a "luxury tax" on high-end vehicles, inheritance taxes, or interest on posible income streams from it.

The best way to go about fulfilling your tax obligations over your RV will be to consult an accountant and ask him to enlist the taxes to pay on the motor vehicle. With these factors in mind, let's take a look at some of the most tax-friendly states for RV registration.

Don’t let the IRS rob your entire piggy-bank. Let’s get into it!

What are the Taxes you Need to Register an RV per State?

Well, the Recreation Vehicle Industry Association (RVIA) created this chart that demonstrates them in order of most registered RVs to least. It also has all of the information on taxes you need to pay for your vehicle. So, get that calculator ready!

|

State |

Number of RVs |

Income Tax |

Sales Tax |

Property Tax |

|

California |

876,938 |

1% |

7.25% - 10.25% |

California's basic annual vehicle license fee is 2% of the vehicle's purchase price, depreciated over an 11-year period. |

|

Florida |

468,684 |

No personal income tax |

3% plus discretionary sales surtax |

6% of the cost of the vehicle |

|

Texas |

406,586 |

No personal income tax |

6.25% minus any trade-in allowance |

No estate tax |

|

Ohio |

393,207 |

2.765% to 3.990% |

5.75% |

No state estate tax |

|

Michigan |

292,303 |

4.25% |

6% |

No state estate tax |

|

Pennsylvania |

267,986 |

3.07% |

6% statewide 7% for residents of Allegheny County 8% for City of Philadelphia |

1.36% |

|

North Carolina |

266,025 |

5.25% |

3% or to a maximum of $2,000 |

0.70% |

|

Illinois |

252,548 |

4.95% |

6.25% |

2.08% |

|

New York |

225,222 |

4% - 10.9% |

4% |

No estate tax |

|

Indiana |

217,745 |

3.15% |

7% |

No estate tax, but you have to pay local tax. |

|

Arizona |

205,388 |

2.50% |

5.6% including county and city taxes |

Arizona's vehicle tax applies to the vehicle's “taxable value,” which is 60% of the manufacturer's base retail price for the first year after initial registration. This value decreases by 16.25% for each succeeding year. For the first year, the tax is $2.80 for each $100 in value. |

|

Wisconsin |

195,832 |

3.54% - 7.65% |

5% |

No estate tax |

|

Georgia |

182,201 |

1% - 5.75% |

6.6% |

No estate tax, but you have to pay local tax. |

|

Minnesota |

176,454 |

5.35% - 9.85% |

6.5% |

$15 to $1,760 annually. For motor homes and recreational vehicles, the rate decreases to 75% of the first year amount as the vehicle ages. |

|

Oregon |

172,878 |

4.75% - 9.90% |

1.5% business tax for an LLC RV |

No estate tax |

|

Washington |

168,232 |

No personal income tax |

6% + Excise taxes of .3% or more |

No estate tax, but you may need inheritance tax. |

|

Virginia |

158,551 |

2% - 5.75% |

4.3% |

No estate tax, but you need to pay local tax |

|

Missouri |

150,071 |

4% |

4.225% +8.33% av. Local tax |

No estate tax, but you need to pay local tax |

|

Colorado |

140,903 |

4.40% |

2.9% + county tax + city tax + district tax |

Colorado's annual specific ownership tax is based on a vehicle's “taxable value,” which is 85% of the manufacturer's suggested retail price, excluding federal excise taxes, transportation or shipping costs, and preparation and delivery costs. The tax rate is 2.1% in the first year and is reduced as the vehicle ages. |

|

Tennessee |

138,556 |

No personal income tax, but dividends and interest income are taxed. |

7% |

No estate tax |

|

Iowa |

128,864 |

0.33% - 8.53% |

5% |

Iowa charges an annual fee for motor homes that varies depending on the vehicle class and price. For new motor homes, the annual fee ranges from $90 to $400 |

|

Alabama |

122,059 |

6.50% |

4% + county rate+ city rate |

No estate tax, but you need to pay local tax. |

|

South Carolina |

118,464 |

0% - 6.5% |

6% |

No estate tax, but you need to pay local tax. |

|

New Jersey |

118,354 |

1.4% - 10.75% |

6.225% |

No estate tax |

|

Massachusetts |

115,253 |

5% |

6.25% |

Massachusetts requires local governments to collect an excise tax in lieu of any local property tax. The tax is $25 per $1,000 of valuation (2.5%). The minimum tax is $5. The state motor vehicle commissioner determines the valuation based on the manufacturer's list price for the vehicle's model, make, and year. Maximum valuations decrease as the vehicle ages. |

Which are the 10 Most Tax-Friendly States to Register an RV?

In contrast to the most popular states to register an RV, these are actually the most tax-friendly places to register. And we know what you are thinking: how come they aren’t the same?

Well, there are a ton of factors that go into selecting a place to register your RV, not just only taxes. Keep in mind that while you may not be in the most popular destination for RVs (and this normally comes with good reason), you will be able to save a pretty penny!

1. Montana

Montana is often cited as the most tax-friendly state for RV owners. There are a few reasons for this.

First, there is no sales tax in Montana, which can save you a significant amount of money if you're buying a new RV. Additionally, Montana has relatively low registration fees, and there is no annual property tax on RVs. Finally, Montana has no luxury tax, so you won't be hit with any surprise fees.

It may just be the best place to register! But if you don’t think Montana is really for you, we have some other options.

2. South Dakota

South Dakota is another state that is often mentioned as a tax-friendly option for RV owners. Like Montana, South Dakota has no sales tax, which can save you a lot of money on a new RV purchase.

Additionally, South Dakota has relatively low registration fees, and there is no annual property tax on RVs. Finally, South Dakota has no luxury tax, so you won't be hit with any unexpected fees either.

3. Florida

Florida is a popular state for RV owners, and it's also tax-friendly. While Florida does have a sales tax, it is relatively low compared to some other states.

Additionally, Florida has a flat registration fee of $13.50 - $47.50 per year depending on the weight of the vehicle, which is much lower than many other states. There is also no annual property tax on RVs in Florida.

4. Texas

Texas is another state that is often mentioned as a tax-friendly option for RV owners. While it does have a sales tax, it is also relatively low compared to some other states, though not as low as Florida.

Furthermore, Texas has a flat registration fee of $50.75 - $932.40 per year depending on the weight, which is lower than many other states. There is also no annual property tax on RVs in Texas. But you may be hit with a luxury tax.

5. Oregon

Oregon is another tax-friendly state for RV owners. There is no sales tax in Oregon, which can save you a significant amount of money on a new RV purchase.

Registration fees in Oregon are relatively low, and there is no annual property tax on RVs. However, it's worth noting that Oregon does have a weight-mile tax.

You may be asking yourself: “how do I know if my RV is subject to a weight-mile tax?”

The weight-mile tax applies to commercial vehicles and some non-commercial vehicles, depending on their weight and usage. Check with the state you plan to register your RV in to see if your vehicle is subject to this tax.

6. Delaware

Delaware is a small state, but it's a tax-friendly option for RV owners. There is no sales tax here, which can save you a lot of money if you're buying a new RV. Additionally, registration fees in Delaware are relatively low compared to other states, and there is no annual property tax on RVs.

7. New Hampshire

New Hampshire is another state with no sales tax, which can save you a lot of money on a new RV purchase. Additionally, registration fees in New Hampshire are relatively low, and there is no annual property tax on RVs.

However, it's worth noting that New Hampshire does have a "road toll" that applies to certain vehicles, so be sure to check if your RV is subject to this fee. And we will be honest with you, it’s likely going to be the case.

8. Indiana

Indiana is a tax-friendly state for RV owners. While Indiana does have a sales tax, it is relatively low compared to some other states like California. Additionally, registration fees in Indiana are relatively low, and there is no annual property tax on RVs.

Finally, Indiana has no luxury tax, so you won't be hit with any unexpected fees. This might just be the option if you’re looking to save a pretty penny!

9. Arizona

Arizona is another state that is often mentioned as a tax-friendly option for RV owners. While Arizona does have a sales tax, it is relatively low compared to some other states. Additionally, registration fees in Arizona are relatively low, and there is no annual property tax on RVs.

10. Nevada

Last but not least, Nevada is another tax-friendly state for RV owners. There is no sales tax in Nevada, which can save you a significant amount of money on a new RV purchase. Additionally, registration fees in Nevada are relatively low, and there is no annual property tax on RVs.

However, it's worth noting that Nevada does have a "governmental services tax" that applies to certain vehicles, so be sure to check if your RV is subject to this tax. And calculate all costs with an accountant if necessary.

Conclusion

As an RV owner, choosing where to register your vehicle is an important decision that can have a significant impact on your budget. By considering factors like sales tax rates, registration fees, and property taxes, you can make an informed decision about which state is the most tax-friendly for your needs.

The ten states listed above are some of the most tax-friendly options for RV owners, but be sure to do your own research to determine which state is the best fit for you. And check the updated fees given they change a lot.